In an ever-evolving financial landscape, the adage ‘practice makes perfect’ resonates more than ever, especially for investors and traders eager to navigate the tumultuous seas of the stock market. Demo trading platforms offer a haven for those looking to sharpen their understanding without risking the proverbial farm. But not all platforms are created equal, and when it comes to real-time market simulations, there’s a world of difference between run-of-the-mill and revolutionary.

The demo promise: a prelude to market mastery

For fledgling investors in the UK, the journey often begins with a simple Google search: “How to invest online?” Demo trading platforms are frequently the destinations for these digital explorers, offering simulated environments that mimic real-world trading scenarios without the attendant financial peril.

The concept is simple yet profound. These platforms allow you to create a virtual portfolio, execute trades, and experience the highs and lows of the market in real-time without using real money. This approach to ‘paper trading’ has proven invaluable, providing novices with a platform to learn the intricacies of the market in a sandbox distinctly separate from their actual investment strategy.

Investing online is fraught with considerable risk. The fast-paced nature of the market demands constant vigilance and an understanding of how different factors – economic, political, and financial – influence it. Demo trading platforms offer a no-risk way to gain familiarity without fear of loss.

The sterling benefits of real-time simulations

Real-time market simulations are much more than a digital playground for aspiring traders. They represent an essential early-stage opportunity for education and preparation rooted in actual market conditions. Let’s explore the manifold advantages they offer to UK investors.

A taste of reality: realistic trading experience

Unlike historical data simulations or delayed market information, real-time simulations provide a taste of current and relatable reality. This immediacy offers an invaluable edge, allowing traders to hone their perceptions and reactions to real-time market moves.

Zero to hero: risk-free practice and learning

The absence of capital at stake means traders can experiment without consequence. This freedom from risk makes it an ideal environment for learning about the market, investment instruments, and the mechanics of trading itself.

Sword sharpening: testing trading strategies

There is no feeling like validating a new approach for the strategically minded trader. Real-time simulations allow you to play out various investment strategies, tweaking and adjusting in response to unfolding market events in a quest for the elusive edge.

Confidence and control: building the mindset of a trader

One of the most crucial aspects of the demo platform is the confidence it begets. As users witness their strategies succeed or fail, they cultivate a disciplined approach and a deeper understanding of the psychological element inherent in trading.

A masterclass in market dynamics

Understanding market dynamics is a subtle art that grows with experience. Real-time simulations are the classroom where the foundation of this knowledge is laid.

Unveiling the veil: price movement analysis

Price movements are like the market’s language, filled with nuance and clues for the savvy trader. Through real-time data, participants can decipher these movements, discerning patterns and understanding their implications.

Crafting the net: trading strategy development

Informed by real-time data, traders can craft and test their strategies in response to the live flux of the market. The iterative process of making and evaluating decisions underpins a strategy’s evolution towards one that’s genuinely robust and adaptable.

Riding the wave: risk management and emotional control

Risk is the constant companion of every investment. Learning to manage it is paramount, as is developing the emotional fortitude to stay the course when the market turns. Real-time simulations offer a controlled environment to practice these skills, which is crucial in trading.

The right choice for the right stuff

All demo trading platforms promise practice, but not all can deliver the immeasurable benefit of real-time market simulations to the UK investor. When choosing a platform, it’s essential to look beyond the surface to assess the depth of the experience offered.

Features to watch: critical indicators of quality

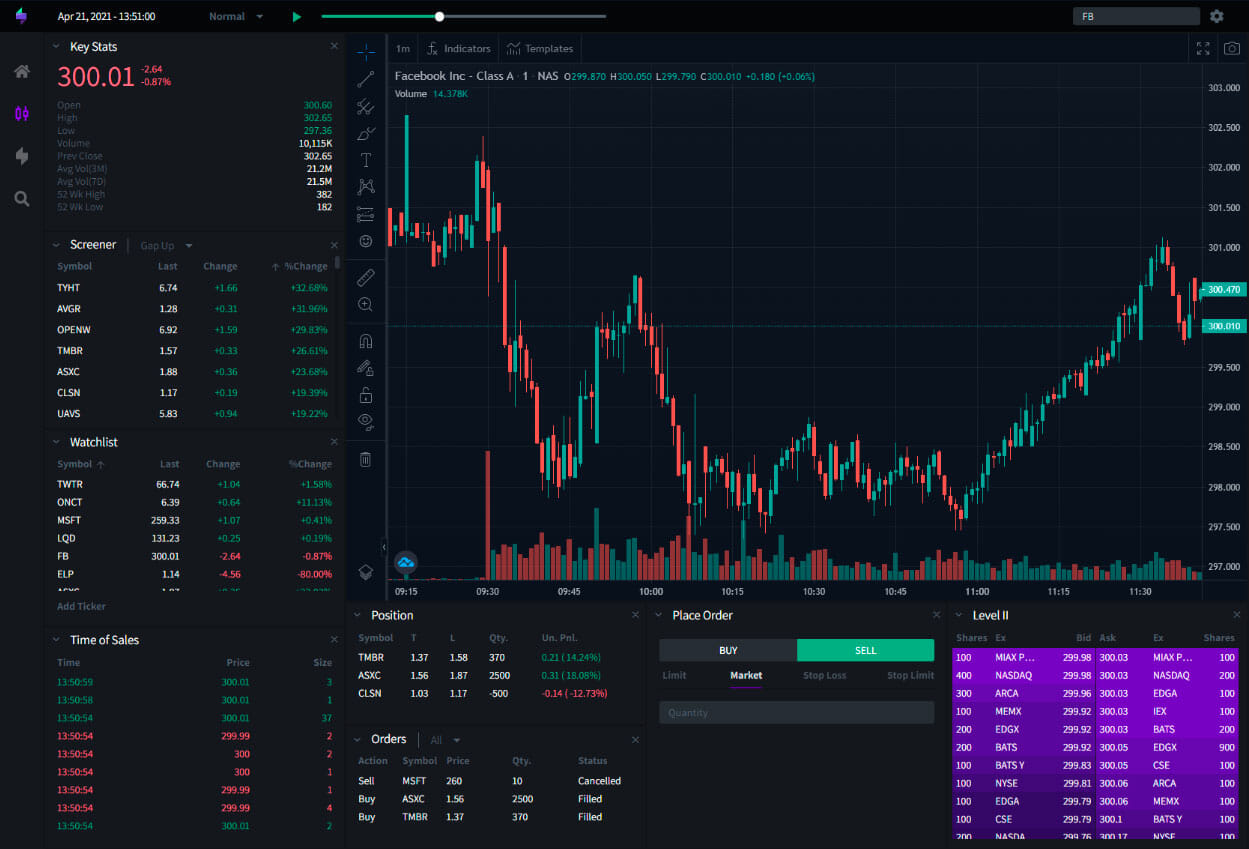

An array of features distinguishes a superior trading platform. Look for analytical tools, market research, and access to various markets and asset classes. These will enrich your learning experience and lay the groundwork for a more holistic understanding of investment.

Timeliness is trade-lines: real-time data matters

Always ensure that the demo platform offers real-time data—knowing that every fluctuation in your portfolio is occurring as it does in the real market adds an irreplaceable element of urgency and reality.

User experience: intuitive design and functionality

An intuitive interface accelerates the learning curve. Clunky screens and hard-to-find tools can obscure the learning process. The best platforms are often the simplest, providing clear, concise information and unobtrusive user experience.

The support system: customer care and resources

Even in the realm of practice, support is crucial. Look for platforms that offer a robust customer service network and a wealth of educational resources—webinars, tutorials, and support forums will prove immensely helpful as you refine your approach.